2023 Green Energy Savings Ahead

By Guest Blogger Marissa Joyce, Gwyn Services

On August 16th, President Biden signed the Inflation Reduction Act into law, a sweeping piece of legislation that affects many areas of the national economy. The coverage of the law has been surprisingly circumspect when it comes to outlining the ways this legislation can save YOU money. However, the savings on eco-friendly home renovations are significant, and taking advantage of them can save you BIG money!

We’re here to break down parts of this new policy, and how they can save you cash!

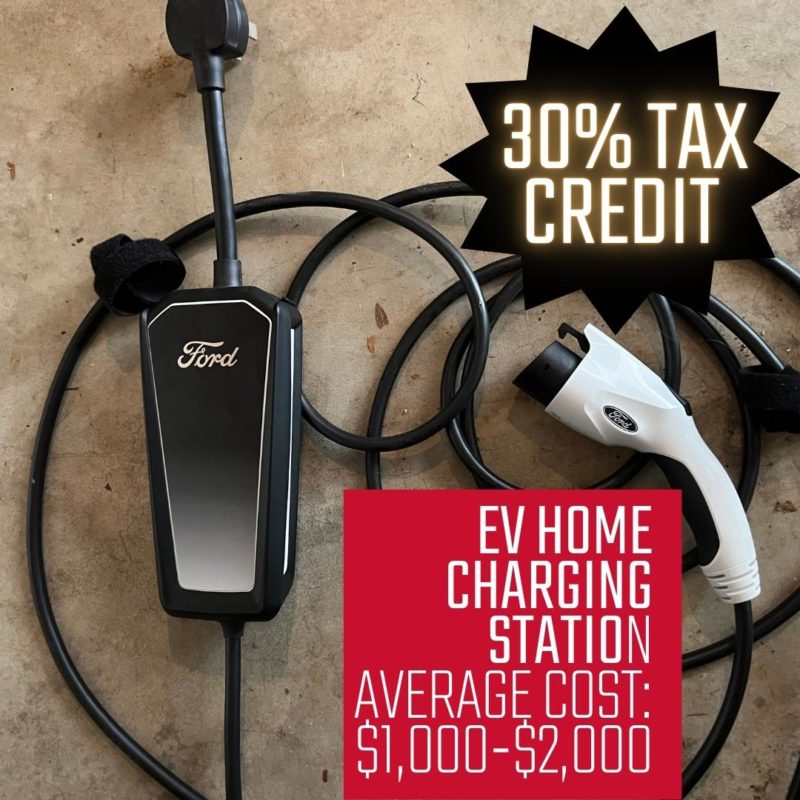

One of the most immediate results of the Inflation Reduction Act is that Tax Credits for energy saving home improvements that were set to expire in 2022 have been expanded until 2034. The majority have been vastly expanded. Starting in 2023, homeowners will receive a tax credit of 30% of the cost of installing energy efficient home products. These would include: windows, exterior doors, air conditioning units, updated electric panels, water heaters, furnaces, heat pumps, and home energy audits. Even more significant, the prior $500 lifetime limit for such credits has been replaced by a $1,200 annual limit. This means you can save annually when doing home improvements!

Rebate Program

The legislation also includes the High-Efficiency Electric Home Rebate Program. This provides rebates for qualifying energy-efficient electric appliances such as stoves, washers, dryers, and water heaters, and certain electrical upgrades to your home which improve energy efficiency. This rebate program is available for residents making up to 150% of median income in the area.

Electric Vehicles

Are you or your partner dreaming about purchasing an electric vehicle? You may also have reason to celebrate- starting in January, you can claim a credit of up to $7500 on new EVs, and $4500 off of pre-owned electric vehicles. Homeowners can also collect up to 30% of the cost of installing a home charging station for an electric vehicle.

Residential Clean Energy Credit

Finally, the Inflation Reduction Act contains one final bonus- the Residential Clean Energy Credit. Under this provision, homeowners can claim 30% of the cost of installing a renewable energy system in their home. Qualifying systems include ones that use solar, wind, or geothermal power to produce energy, heat water, or regulate the temperature in your home.

All of these green energy technologies and improvements have dropped in price dramatically over the past 5 years. And now, with the introduction of these tax credits, it is making your home eco-friendly is more affordable than ever before! Gwyn Services has worked hard to stay on the leading edge of renewable technology. We have the knowledge and experience to help you do your home upgrade right! Want to learn more? Give Gwyn Services a call today! (336) 774-1818

- Sponsored by Gwyn Services

Want to see more blogs like this and get notifications on local events and happenings? Subscribe to our free weekly newsletters here.